8 Things to Consider Before You Make Investing Decisions: You might have been wondering whether you should make adjustments to your investing portfolio in light of recent market happenings. The SEC’s Office of Investor Education and Advocacy is concerned that certain investors, especially bargain hunters and mattress stuffers, are making hasty investment decisions without taking their long-term financial goals into account. While we cannot advise you on how to handle your investment portfolio in a turbulent market, we are publishing this Investor.

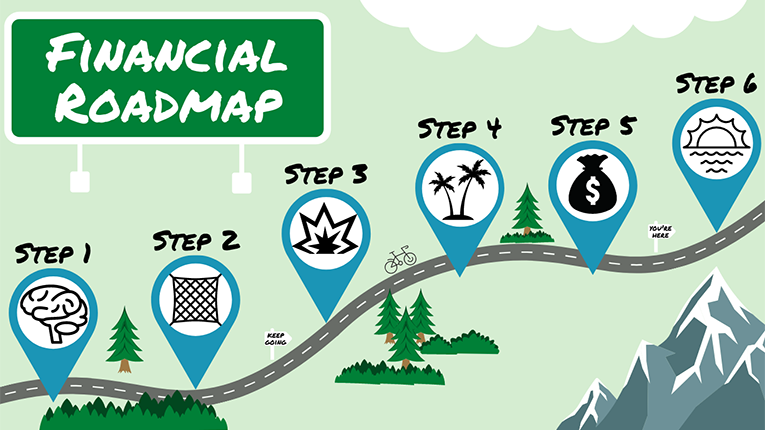

1. Draw a personal financial roadmap.

Before making any investment decisions, sit down and examine your complete financial condition, especially if you’ve never created a financial plan before.

The first step towards effective investing is determining your goals and risk tolerance, which you may do on your own or with the assistance of a financial advisor. There is no assurance that your investments will provide a profit. However, if you learn the facts about saving and investing and implement.

2. Evaluate your comfort zone in taking on risk.

Every investment has some level of risk. If you want to buy assets, such as stocks, bonds, or mutual funds, it’s critical that you understand the risk of losing part or all of your money before you invest. Securities, unlike deposits at FDIC-insured banks and NCUA-insured credit unions, are normally not federally insured. You may lose your principle, or the amount you invested. This is true even if you buy your investments through a bank.

The possibility for a higher investment return is the incentive for taking on risk. If you have a long time horizon for your financial goals, you are more likely to generate more money by carefully investing in asset categories with higher risk, such as stocks or bonds, rather than limiting your investments to assets with lower risk, such as cash equivalents. Investing purely in cash, on the other hand, may be beneficial for short-term financial goals.

3. Consider an appropriate mix of investments.

An investor can assist guard against severe losses by integrating asset categories with investment returns that fluctuate depending on market circumstances within a portfolio. Historically, the returns on the three major asset classes – stocks, bonds, and cash – have not risen in tandem. Market factors that drive one asset category to perform well frequently lead another asset category to perform poorly. By investing in many asset classes, you lower the chance of losing money and smooth out your portfolio’s overall investment results.

Furthermore, asset allocation is critical since it has a significant influence on whether you will reach your financial goals. If you do not incorporate enough risk in your portfolio, your investments may not provide a high enough return to fulfil your objectives. For example, if you’re saving for a long-term goal like retirement or education.

4. Be careful if investing heavily in shares of employer’s stock or any individual stock.

Diversifying your investments is one of the most essential techniques to reduce the risks of investing. It goes without saying: don’t put all your eggs in one basket. You may be able to limit your losses and lessen the swings of investment returns by selecting the correct group.

If you invest extensively in shares of your employer’s stock or any particular stock, you will be exposed to severe investment risk. If the stock performs poorly or the firm goes bankrupt.

5. Consider dollar cost averaging.

Expanding your financial holdings is one of the most essential techniques to reduce the risks of investing. It goes without saying: don’t put all your eggs in one basket. You may be able to limit your losses and lessen the swings of investment returns by selecting the correct group.

If you invest extensively in shares of your employer’s stock or any particular stock, you will be exposed to severe investment risk. If the stock performs poorly or the firm goes bankrupt, you will almost certainly lose a lot of money (and maybe your job).

6. Consider rebalancing portfolio occasionally.

Rebalancing means returning your portfolio to its original asset allocation balance. You will guarantee that your portfolio does not overemphasise one or more asset groups by rebalancing.

You may rebalance your portfolio depending on the calendar or on the performance of your investments. Many financial gurus advise investors to rebalance their portfolios on a regular basis, such as every six or twelve months. The calendar serves as a reminder of when you should consider rebalancing, which is an advantage of this strategy.

7. Avoid circumstances that can lead to fraud.

Scammers, like everyone else, read the news. They frequently exploit a well publicised news article to entice potential investors and make their “opportunity” appear more real. Before investing, the SEC suggests that you ask questions and verify the answers with an independent source.

8. Take advantage of “free money” from employer.

In many employer-sponsored retirement plans, the employer will match some or all of your contributions. If your employer offers a retirement plan and you do not contribute enough to get your employer’s maximum match.

Read also : businesnewdaily

1 thought on “8 Things to Consider Before You Make Investing.”